What is FORM 26AS?

FORM 26 AS is a consolidated statement issued by Income Tax Department (TIN - Tax Information Network) to PAN holders which contains following details:- Tax deducted at Source (TDS) (Deposited by tax deductor).

- Self Assessment / Advance Tax (Deposited by individual).

- Tax collected at Source (TCS).

- Tax Refund from Income Tax Department during financial year.

- High value transactions in respect of Mutual Fund and Shares.

Individual can check TDS details in FORM - 16 issued by Tax Dedcutor, but if individual wants to check all above details on same place, can check FORM 26AS.

How to Check FORM 26AS?

FORM 26AS can be viewed by PAN holders from any of the websites as below:

- Income Tax India E-Filiing Website - Once you registered with this site using PAN, you can check Tax Credit Statement - FORM 26AS free of cost.

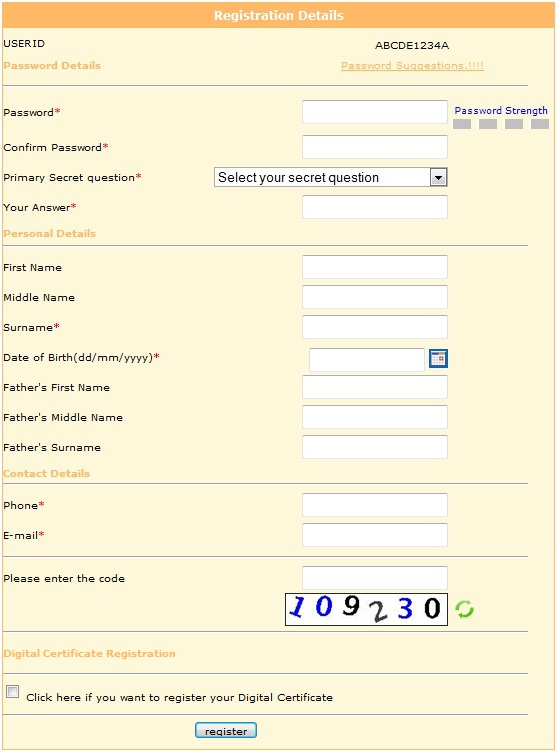

- NSDL Website - This facility is available to PANs that are registered with Tax Information Network (managed by NSDL - National Securities Depositories Limited) for view of Tax Credit Statement - FORM 26AS. The PAN holder has to fill up an online Registration form for such purpose. Thereafter, verification of PAN holder's identity is done by the TIN-Facilitation Centre personnel either at PAN holder's address or at the TIN-facilitation center that has been chosen by the PAN holder. The verification involves a cost at prescribed rates. Once authorised, the PAN holder can view Tax Credit Statement online.

- Few Bank sites - If you are customer of any of below banks then you can check Tax Credit Statement - FORM 26AS online after login with your customer id free of cost:

- Allahabad Bank

- Andhra Bank

- Axis Bank Limited

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Citibank N.A.

- City Union Bank Limited

- Corporation Bank

- HDFC Bank Limited

- ICICI Bank Limited

- IDBI Bank Limited

- Indian Overseas Bank

- Indian Bank

- Karnataka Bank Limited

- Kotak Mahindra Bank Limited

- Oriental Bank of Commerce

- State Bank of Bikaner & Jaipur

- State Bank of Hyderabad

- State Bank of India

- State Bank of Mysore

- State Bank of Patiala

- State Bank of Travancore

- Syndicate Bank

- The Federal Bank Limited

- The Karur Vysya Bank Limited

- The Saraswat Co-operative Bank Limited

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

How to view FORM 26AS using Income Tax India E-Filing site?

To use this service PAN holders needs to login to Income Tax India E-Filing Site, if you are not registered then refer: One Time Registration with IncomeTaxIndiaE-Filing Site.- Login using your PAN and password.

- Goto MyAccount -> View Tax Credit Statement (Form 26AS) as displayed below:

- It will prompt for verification information below:

- Provide the details and click on Submit button, it will display another page which contains message "You will be redirected to the NSDL website to view Form 26AS (Tax Credit Statement)." along with two buttons (Confirm & Cancel). Click on Confirm button.

- You will be redirected to Tax Information Network - NSDL site as below:

- Click on View FORM 26AS highlighted as above screen shot, It will open FORM 26AS. On this page user has option to view previous / current Assessment year's FORM 26AS. Sample FORM 26AS displayed as below:

If you scroll down in FORM 26AS, you will find other portions of FORM 26AS (PARTB, PARTC and REFUND details).

Understand FORM 26AS?

It has 4 sections: PART A, PART B, PART C, Tax Refund details & High value transaction of Mutual fund and shares.

PART A: Details of TDS

It contains following details:

Name of Deductor

TAN of the Deductor

Section under which deduction made - for details check Legends in form

Date of Payment Credit

Amount Paid / Credited

Tax Deducted (Tax + Edu. Cess + Surcharge)

TDS Deposited

Status of Booking (P/F/U) - for details check Legends in form

Date of Booking

Remarks (in case of reversal)

PART B: Details of TCS

It contains following details:

Name of Collector

TAN of the Collector

Section under which collection made - for details check Legends in form

Date on which amount paid / debited

Amount Paid / Debited

Amount of Tax Collected (TCS + Edu. Cess + Surcharge)

TCS Deposited

Status of Booking (P/F/U) - for details check Legends in form

Date of Booking

Remarks (in case of reversal)

PART C: Details of Tax Paid (Other than TDS & TCS)

This section contains Self Assessment, Advance tax paid by individual by themselves. It contains following details:

Major Head Code # - for details check Legends in form

Minor Head Code % - for details check Legends in form

Tax

Tax

Surcharge

Education Cess

Interest

Total Tax

BSR Code

Date on which Tax Deposited

Challan Serial No.

Remarks (in case of reversal)

Details of Paid Refund

This section contains any refund received from Income Tax Department in current assessment year, refund may be of any financial year. It contains following details:

Assessment year for which refund is paid

Mode of Payment $ - for details check Legends in form

Amount of Refund

Date of Payment

Remark

On TIN NSDL site, Individual can save FORM 26 AS in PDF and text format. There are options available after all above sections.

Assessment year for which refund is paid

Mode of Payment $ - for details check Legends in form

Amount of Refund

Date of Payment

Remark

On TIN NSDL site, Individual can save FORM 26 AS in PDF and text format. There are options available after all above sections.

FORM 26AS for Previous Year:

Individual can view FORM 26AS from Assessment Year 2006-07 on TIN - NSDL site. Change the assessment year in drop-down list located on upper left corner of the page and click on Submit button.Clarification / doubt in FORM 26AS?

Possible reasons for mismatch/missing entry in Part A/B (Details of TDS or TCS) are as follow:-

- Deductor/collector has not filed quarterly TDS/TCS return.

- Deductor /collector has not quoted or has wrongly quoted your PAN in the TDS/TCS return.

- You have not provided PAN or have provided wrong PAN to the deductor/collector

- The TDS/TCS return filed by the deductor/collector is rejected in the system.

If you have any doubt / clarification required in Tax Credit statement for particular assessment year then please check with Tax deductor.

If they are not able to help you then you can contact TIN Call Centre NSDL for any clarification which have not been resolved by deductors. Below are contact details of TIN Call Centre NSDL:

Address: TIN Call Centre National Securities Depository Limited,

3rd Floor Sapphire Chambers,

Near Baner Telephone Exchange,

Baner, Pune - 411045 (Maharashtra).

Telephone: 020 2721 8080

Fax: 020 2721 8081.

Email: tininfo@nsdl.co.in

Note: For more details on FORM 26AS refer FAQ on FORM 26AS.